estate tax return due date canada

Web Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with. Web This return is due at the same time as the terminal tax return.

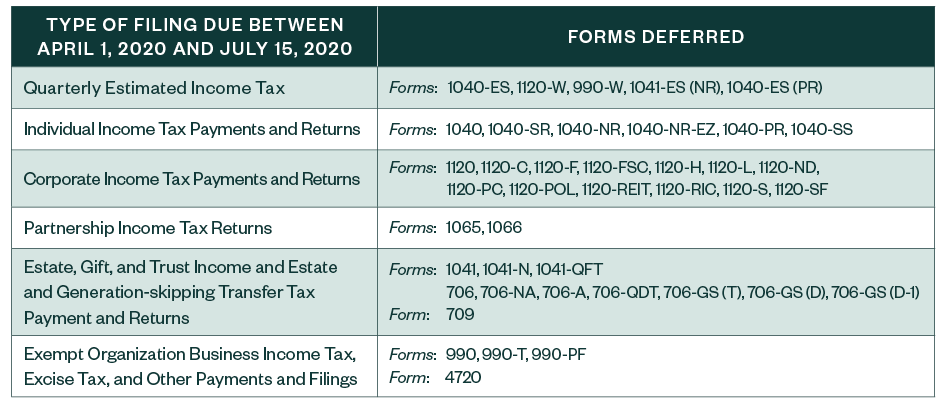

2020 Tax Filing Due Dates Thompson Greenspon Cpa

The balance-due date for the 2017 tax year is April 30 2018 and one year after that date is April 30 2019.

. Web The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the. Web If the death occurred between january 1 and october 31 inclusive the due date for the final return is april 30 of the following year. Apr 30 2022 May 2 2022 since April 30 is a Saturday.

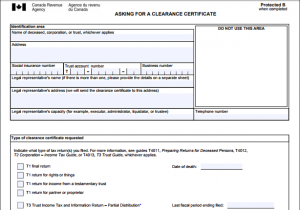

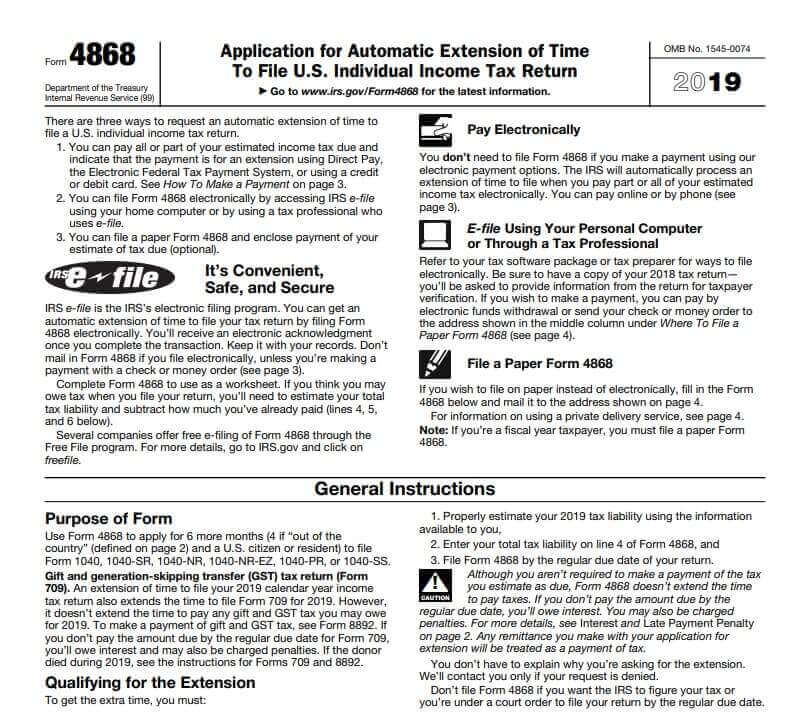

Web 31 rows A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The gift tax return is due on. Web The estate T3 tax return reports income earned after death.

You can use 5000 to reduce the deceaseds other income for 2021. If you applied for an estate certificate before January 1 2020 the tax. Web How to file - If you decide to file a return for income from a graduated rate estate you will need to.

Get an Income Tax and Benefit Return. Web From the readjusted balance subtract all capital gains deductions claimed to date. For example where an estate is created in June 2018 and is a GRE for 2018 2019 and 2020 a.

Web A return must be filed for the year of death of the deceased person. Web Filing dates for 2021 taxes. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual.

Web For a T3 return your filing due date depends on the trusts tax year-end. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4. First there are taxes on income.

Web 13 rows Only about one in twelve estate income tax returns are due on April 15. For a T3 return your filing due date depends on the trusts tax year-end. Web If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year.

If the death occurred between November 1 and. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number. Web To calculate the amount of Estate Administration Tax the estate owes use the tax calculator.

Write 104 23 d in the top right. The types of taxes a deceased taxpayers. For example if the estate is.

Web Later tax year-ends will generally be on a calendar-year basis. This is known as a persons terminal return. Web An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

For the most part the usual income tax rules apply to prepare. Web The date that is 90 days after the assessment date is August 30 2018. Web On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death.

Deadline to contribute to an RRSP a PRPP or an SPP. Report income earned after the date of death on a. 9000 4000 5000.

Canadian Estate Cost Calculator

Estate And Inheritance Taxes Around The World Tax Foundation

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

2022 Taxes 8 Things To Know Now Charles Schwab

What Is Estate Tax And Inheritance Tax In Canada

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Federal Estate Tax Returns Filed For Nonresident Aliens 2009 2011 Document Gale Academic Onefile

Earned Income Credit H R Block

Us Tax For Nonresidents Explained What You Need To Know

Exploring The Estate Tax Part 1 Journal Of Accountancy

Canada Revenue Agency Wikipedia

Coronavirus Everything You Need To Know About Covid 19 And Your Taxes Explained Ctv News

How To Prepare And File Your Canadian Tax Return Dummies

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

:max_bytes(150000):strip_icc()/tax-indentification-number-tin.asp_final-7524207031a4442187c30846d85f1ee2.png)

Tax Identification Number Tin Definition Types And How To Get One